The star performers in last year's Australian magazine story defied a cool market for discretionary spending while delivering on positive consumer sentiment for food and entertainment and home and lifestyle glossies. The Audit Bureau of Circulations survey accounted for 132 titles, though more than 1000 titles are available on Australian newsstands.

While Morrison Media's indie title Frankie appealed to more people in the alt/indie/creative/'special interest' demographic, The Monthly also grew its sales by 17.8% in an election year where Twitter made a resounding debut on the political front. Clearly, analysis and long-form journalism still attract a premium audience (all 29,476 of them) willing to part with their pocket money.

THE GLOSSIP WEEKLIES

The mass weekly category experienced a 6.4% across-the-board decline with fashion weekly Grazia contributing a sales drop of 19% to the total. She can count herself lucky to be invited back to the party. ACP's managing director Phil Scott pointed to Grazia's not-nearly-as-bad quarter-on-quarter performance (-2.8%) and personnel changes at the masthead while telling The Australian Financial Review, "it won't drop any further".

THE GLOSSIES

Women's lifestyle titles took a -3.8% hit while fashion dipped -8.2%. The nation's biggest selling magazine, The Australian Women's Weekly, lost 3.2% of sales with Phil Scott attributing that decline to an increased cover price. Harper's BAZAAR was a good news story for ACP, while stablemates SHOP Til You Drop and Madison proved to be relatively resilient.

THE FOODIES

The nation's passion for food continued with the biggest launch of the year, News Magazines' MasterChef, buoying sales and trimming back circulation of Recipes+ (acquired by ACP in 2010) and the top-selling $2.95 Super Food Ideas (owned by News Magazines). News Magazines' Sandra Hook told The Australian that magazines still have consumer resonance, "if you have the right product".

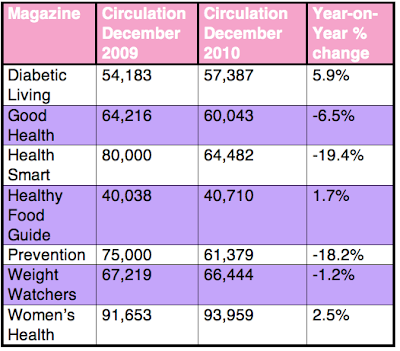

THE HEALTHIES

The health segment experienced a 9.1% sales decline in 2010, though Pacific Magazines' Women's Health, which added more colour to its formerly monochrome covers, continued to attract more buyers, potentially taking attention away from mainstream women's lifestyle magazines (down 3.8%) including Cleo, Cosmopolitan and the Women's Weekly. Pacific's Prevention – the older sister to Women's Health – didn't fare nearly as well, shedding 18.2% of its circulation.

THE HOMIES

The home and lifestyle category lifted 1.3% with the "fancier" upmarket titles, House & Garden (ACP), Belle (ACP), Country Style (News Magazines) and Vogue Living (News Magazines) experiencing the biggest growth, though Pacific's Better Homes & Gardens remains the largest seller in the category and the third biggest selling magazine in the country behind the Women's Weekly and Woman's Day.

THE TEENIES & TWEENIES

The story isn't pretty, though publishers will be working on strategies to increase the appeal of magazines to the youth market.

'DA BOYZ

Despite its marketing push to be the most-talked-about lad mag on the stands, Zoo Weekly (launched by Emap in 2006, acquired by ACP the following year and selling 120,000+ copies in 2008) copped a circulation fall giving it less than 100,000 copy sales a week. Our Saint Mary MacKillop would be pleased.

2 comments:

How come Russh's new figures are missing? Also where is GQ?

Neither GQ nor RUSSH took part in this Audit Bureau survey.

Cheers,

Erica

Post a Comment